How-to: The Golden Path to Upscale Your Insurance Business - Financial series, Volume 1

The traditional distribution strategies will - done right - give you a linear growth in sales. If you aim for exponential growth in your sales figures, you have to look elsewhere. And in this blog article, we tell you what to zoom in on.

A story from the real world.

In 2013, my team convinced Alka - Denmark's 5th largest insurer - about two facts:

- That personal lines non-life insurance can be bought - as opposed to only being sold.

- That you could build an online customer journey without showing the customer any products but still helping him or her make a decision.

Long story short, after working with the company Alka for 4 years, they sold about 40% of their total insurances via their website, also known as online direct. Further, they scored a combined ratio of around 85. Tryg, the largest insurer in the Nordics, ended up acquiring Alka for €1.1 billion.

I’m not saying that the online direct was the sole reason for the acquisition. But it surely wasn’t a bad thing.

Fast forward to today, if any given insurance company asked me “Should we create our own direct online channel?” Then, my answer would go against the success I was a part of from 2013 and onwards: No, you should probably not make your own online sales channel. Or to be exact: If the sole focus is to sell insurance in the short to medium term, you definitely should not. Branding, employee retention, future-proofing, etc. can after all be good arguments for doing it anyway.

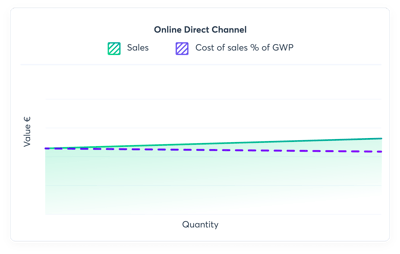

The basic reason for this: It has become too pricey to push a digital customer into a direct online channel. In most European markets right now, the cost of sales in an online direct channel will exceed the traditional manual distribution channels (agents, intermediaries, brokers etc.). Simply because the core product of insurance is defined by having a stable, but lower-than-low active demand from customers. We’ll get back to that later.

Scaling a distribution channel

Insurers ask themselves this question every day: How can we grow policy sales without proportionally increasing our marginal distribution costs?

There is no silver bullet. But in any case, the traditional ways of distribution can’t provide it. This is backed up by the fact that M&A is the main form of growth within the insurance industry.

I guess that you would like an answer that’s more fun to read. So, let’s get into the messy details of what defines the relationship between sales and the marginal cost of sales for various distribution channels. To be exact, we zoom in on the economies of scale of each of the major distribution methods.

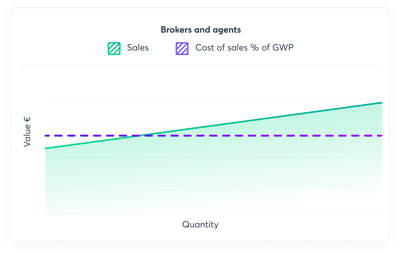

The scaling of brokers and agents

The distribution via brokers and agents is often followed by a high money motive, which in turn gives a more or less stable distribution. This channel is, as far as external channels go, fairly easy to control in terms of returns for the next spent unit of distribution. This means that due to agreements and settled market structures, you know, as an insurer, if you add X amount of money into the channel, you’ll get Y customers out at the other end. However, the marginal cost of sales tends to have a minor increase as you grow this channel. Mostly due to a small loss of efficiency, added administrative costs, higher lead costs, and a cap on customers in the market.

The distribution via brokers and agents is often followed by a high money motive, which in turn gives a more or less stable distribution. This channel is, as far as external channels go, fairly easy to control in terms of returns for the next spent unit of distribution. This means that due to agreements and settled market structures, you know, as an insurer, if you add X amount of money into the channel, you’ll get Y customers out at the other end. However, the marginal cost of sales tends to have a minor increase as you grow this channel. Mostly due to a small loss of efficiency, added administrative costs, higher lead costs, and a cap on customers in the market.

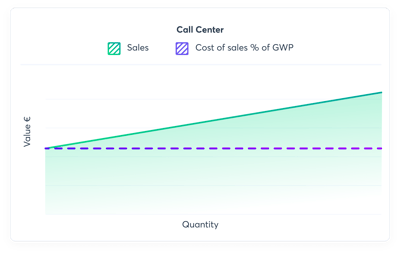

The scaling of call centers

The call centres have most of the forms of scales as the brokers and agents. However, the call centres often have a lower cost of sales as a starting point. Due to the greater control and higher flexibility (be that internal or external call centres), the rise in the marginal cost of sales at scale is smaller than with brokers and agents.

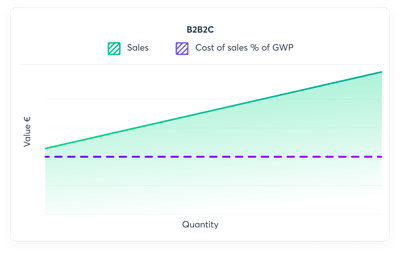

The scaling of B2B2C

Embedded insurance is not new and in most cases, it’s still analogue. If the partnerships are done right, you have aligned economic interests with the ‘middle B’. This means that the cost of sales for the number 1 policy and the number 15.024 policy will be close to the same. The main barrier for scaling this channel is that you’re at the mercy of the partners’ customer acquisition. You may want to double the B2B2C sales. This would need either 1) that the current partners get new customers for their core business. Or 2) that you get new partners.

The scaling of online direct

It’s a fact that the internet is not just a passing fad. The online direct channels to an insurer’s own website, however, struggle to deliver the efficiency that the digital world promises to deliver. The reason is simple. And can be explained with the most basic economic model of all time: Supply and demand market equilibrium.

It’s a fact that the internet is not just a passing fad. The online direct channels to an insurer’s own website, however, struggle to deliver the efficiency that the digital world promises to deliver. The reason is simple. And can be explained with the most basic economic model of all time: Supply and demand market equilibrium.

The Penni.io standard phrase is: Nobody wakes up in the morning thinking about insurance. And that reality doesn’t change just because insurance companies offer their products online. On any given morning there are still only about four people in the whole world who look for insurance :-)

But in the later years, more and more insurers from around the world have made a digital sales offering available across all the customers in the market. So, since there are no more operational barriers to the selling of insurance, the available supply of insurance in the market has gone up. However, the demand side of the equation has stayed pretty much the same. And we know from basic economic theory that when supply goes up without demand following by, the prices drop. Any insurer in the world knows that the competition on the insurance price has increased since the advent of the internet. Who wins in a situation like this? The ones who are distributing insurance for the four people on the demand side (drum roll, please):

Google.

In 2020, $147 billion of the revenue of Alphabet (or 80% of total revenue) comes from Adspace. We know from former and more transparent times at Google that insurance makes up a lot of that number (24% in 2011). Even if we for conservative reasons cut that down to, e.g., 10%, we’re still talking $15 billion that insurers are sending to Google to try to expand their direct channels. So, if you as an insurer want to expand this distribution channel, you know that for every customer you get, the next one will cost you a bit more to win over. This paradox is also known as diseconomies of scale (or increasing marginal costs). And it’s the worst situation to be in while growing a line of business.

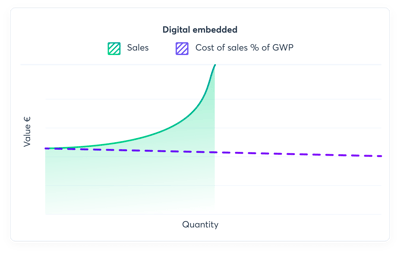

The scaling of digital embedded insurance

In the late years, we’ve seen good cheers for digital embedded insurance. Or digital B2B2C, if you like (in-depth description about the economic potential here). And no wonder why. It’s the only distribution model of insurance that can deliver exponential growth and trim the marginal cost of sales at the same time. Due to several qualities of the distribution model, it can grow both top and bottom lines at the same time. The qualities include:

- No direct marketing.

- Low fixed cost.

- Infinite numbers of partners.

- Not relying on hours or resources.

- No cap on touch points and frequency with the customer.

… And many more. Which we’ll cover in detail in the next blog post that we’ve in the pipeline for you (you didn’t think that I would let you go without a cliffhanger, did you?).

Done well, digital embedded insurance also allows insurers to build up their partner base at a micro cost. Thereby, they grow the pool of potential customers greatly with each partner. It does ask for technology that eases the cloning of end-customer solutions and for fast time to market. As well as knowledge about how to set up customer journeys that converts like crazy. It doesn’t call for new Key Account Managers since the operating model is key. These new partnerships are to be handled as a marketing partnership, as a fixed part of a sales model.

Free Download: Embedded Insurance Index - Part I

When you have that in place, it’s a case of testing out partnerships.

Often, it’s hard to predict which partnerships will have digital success. But if the cost of testing 100 partnerships is low, then the 10 of them that pull it off, give insurers the exponential growth they so deeply need in a sort of linear business. A bit like Marketing, just with a direct sales result.

This article is the first of four that dive into the financials behind digital embedded insurance. If you want to be the first to read the following three articles - and don’t want to miss out on more valuable ideas and insights that will wow your CEO - sign up for our newsletter.

Special thanks to our expert Simon Bentholm.