Cracking the Code to Lower Cost of Insurance Sales and Upgraded Customer Convenience

Dealing with your insurance company’s bottom line is like parenting a teenager: You worry a lot. And you have to keep an eye on it 25/7. It doesn’t have to be like that, though. There are two key factors you should work on to make your bottom line grow: Your cost of sales and customer convenience. And after reading this article, you’ll know how to do exactly that.

Let me start this blog post by setting free my inner Stephen King (though, with less preference for horror and more for nonfiction) and telling you a story:

In 2011, Simon Bentholm - who’s also one of the generous contributors to Penni.io’s blog - walked into Denmark’s ninth-largest insurance company (at that time) to have a look at their online sales flow. The people there raised their eyebrows. They told him insurance is a product that the consumer will never buy - it has to be sold.

Simon wanted to put their belief to sleep.

He began digging into the barriers to online sales that insurers thought were standing in their way. He took each assumption and incorporated them into his design process. He was keen to change the customer journey and spent seven years working closely with the insurer to develop their online sales processes.

In 2018, the insurance company got sold. They were now selling more than 30% of their insurance policies online - and they got acquired precisely due to their digital success.

And that’s my cue for moving on to the topic that’s the answer to all your prayers: No, I’m not talking about Netflix, but digital sales.

Customers Are Ready (and Waiting) for the Online Sales Channel

Insurers face some barriers in the nonstop-evolving world of digital insurance sales. This is where the partnership distribution model holds endless promise and can help crush these barriers. And the Danish insurance market is the perfect example of this.

The insurance industry in Denmark (and in the Nordics in general) has an out-of-this-world-low combined ratio in the P&C segment (starting as low as 80% in the private segment, with a customer loyalty of about 90%).

In other words: They have KPIs that many insurers dream about.

So, why are Danish insurers digital sales champions?

We’ll find the answer at the Danish (born) insurance companies Tryg and Topdenmark who’ll also be the case studies in this article.

One of the reasons why they’re good at making a profit is that they don’t rely solely on agents and brokers. They push for direct, partners, and digital:

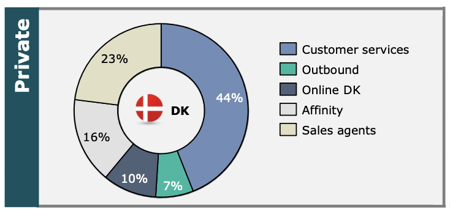

(Source: Topdanmark’s report on Q1 results in 2022, p. 26)

(Source: Topdanmark’s report on Q1 results in 2022, p. 26)

On a global scale, the average combined ratio is 98%. In Q1 2022, Tryg presents a combined ratio of 84.5% and Topdanmark presents 86.9%, which means that their operating profit is 13.5% and 11.1% better than the global average.

Of course, digital sales are not the only reason why they show an impressive combined ratio but it’s certainly important.

The findings from both cases above are suited to other markets and tell us what the future of insurance sales will look like.

That future is one in which insurance companies can upgrade the customer’s convenience (meaning a customer experience that saves the customer time and effort) and cut their cost per sale by growing their online sales through distribution partners. Such as banks, unions, auto manufacturers, real estate companies, and travel agencies.

Costs are kept lower by using the distribution partner’s existing online presence to drive customers to an insurance calculator while using the partner’s stash of consumer data to make the purchasing process simple. The result is a better overall experience for the customer and a higher profit margin for the insurer and the distribution partner.

Why Online Sales Have Not Yet Boomed

The DK and UK chambers of commerce collect data on the link between online and offline sales across a number of industries. Consumers are, unsurprisingly, buying more and more goods and services online.

In Denmark, e-commerce sales had a 17.6% growth in only one year: From €20.7 bn in 2020 to almost €24.3 bn in 2021. The reason? COVID-19.

We’ve seen the same growth in the UK. In February 2020, when the lockdown hit us with what felt like Mike Tyson’s right hook (relentlessly followed by his left uppercut), e-commerce sales were 19.1% of the total retail. In February 2022, the percentage of e-commerce had risen to 27.8%. That’s a jaw-dropping 21% growth year-on-year.

So, customers are used to buying products and services online that cost more than the average yearly premium on a home insurance policy. Even for things like banking and travel.

Danish insurance companies seem to have spotted (the gain of) this trend.

That’s why I’ll unfold how the sales are spread for the two largest non-life insurers in Denmark: Tryg and Topdanmark. They are also the only ones to disclose this data.

In 2019, Tryg Forsikring (Nordics' largest insurer) had only 3% of their private policies sold online. In 2021, that figure had risen to a staggering 10%. In. Two. Years. So, the largest Scandinavian insurer sells 1 in 10 private policies online:

(Source: Tryg’s distribution of new sales in 2021, p. 41)

(Source: Tryg’s distribution of new sales in 2021, p. 41)

In Topdanmark’s case, 17.9% of sales start online and are either fully or partly finished online. So, if it wasn’t for digital sales channels, Topdanmark would likely lose every fifth of its sales.

So, with both insurers, we see that digital sales play a significant part in their total sales. It’s the (profitable) proof of digital sales.

But why don't we see more insurers embracing digital sales channels? There appear to be two factors that limit online conversions:

- The complexity of the IT infrastructure needed to sell insurance products digitally.

- Unproven beliefs based on most insurers’ existing business models.

We won’t focus on the complexity of the technology. Solving that problem is the reason behind Penni.io and our solution Penni Connect. Instead, I’ll explain how the unreasonable beliefs that hold insurers back are fueled - not by fear of new technology but by internal incentives.

Join the company of two experts and get to know how insurers can digitalise their offers.

3 Foolish Unreasonable Beliefs Holding Insurers Back

Online sales remain a tiny percentage for many insurers since most of their distribution is still generated via offline channels.

Also, their workforce involved in sales is first and foremost dedicated to supporting agents and call centre operators. That’s by generating leads, running marketing campaigns, pricing products, and so on.

This means a lot of their resources are dedicated to a process that supports an existing (and so far successful) business model. But it’s also a process that doesn’t support what the (digital) end-customers demand and how they think, act and buy.

There are three beliefs we keep coming across and see as the reasons why only a few insurers are making a strong leap to digital sales.

#1: “You can win a lead online, but you'll lose it offline.”

Can someone please press the Wrong! button?

The demand for insurance is not a zero-sum game. The number of customers interested in insurance is only limited by the insurance company’s CRM configurations. They ‘decide’ how often the company should reach out to customers.

With digital touchpoints across new partners with new customer bases, customer interaction moves from ‘one-off/yearly’ to ‘always on.’ This exposure doesn’t replace existing demand — it creates new and more demand. Isn’t that the most wonderful thing you’ve read today?

As online distribution makes insurance more personal and relevant and easier to interact with, the number of leads will grow. This will result in both a growth in online sales and a rise in digitally acquired leads who convert offline (since not all customers are ready to buy online and may want to consult a field agent or a call centre representative).

To put it in a nutshell: An ‘always-on(line)’ presence will make the end-customer demand and buy insurance as if there were no tomorrow.

#2: “Online sales only appeal to youngsters. If we use an aggressive digital strategy we’ll lose older consumers.”

To me, it’s the same (and just as out-of-date) as listening to people claiming that the earth is flat. Yes, some people still believe that. And no, they don’t go out a lot (they’re afraid of what will happen if they trip, I guess).

Anyway, back on track. Studies show that online sales are rising across all ages. The internet is not a ‘youth phenomenon’: 66% of the population in the EU, across all income classes, ordered or bought goods or services over the internet.

Meanwhile, insurers are now able to price risk with surgical precision thanks to the access to better and more fine-grained data. They can tailor pricing for each customer. Then, the chances that the consumer is offered the right price are better - no matter the distribution channel.

Online customers are offered a targeted price (which is also the correct price). Also, a potential discount rate offered will be aligned with the company’s overall risk profile connected with the partner’s customer base. This better pricing method will attract and engage all generations. Not just the ‘digital natives.’

#3: “Premiums for insurance products sold online are costly because the marketing costs are higher and the profits are lower.”

This is sort of true.

The cost of generating leads online is high and it’s more difficult to get a good ROI on an insurance product. However, this is mainly due to the cost of driving traffic to the insurance homepage. And this is precisely the problem that can be overcome by selling online via distribution partners.

End-customers see insurance as that kind of topic that you bring up when there’s an awkward silence at a dinner party and you’ve run out of things to talk about. And a lot will have to change before the general public engages in it.

Because of that, it takes a mucho mas grande marketing effort to get customers to consider (buying) your product online.

First, you have to pique their interest and lead them to the homepage. Then, once you have them there, you have to keep them hooked while asking for a lot of their time and effort to fill out data. This is needed so you can offer them a tailored quote.

This intense marketing, along with low conversion rates, raises your cost per sale. Also, it’s not exactly making you eager to digitise sales processes. However, you can make the same process so cost-effective that economics (and competitors) will say: “Why didn’t I think of that?!”.

If most of your costs are spent driving the customer to your homepage, you could save considerably by being in the digital environments the customers are already in.

That’s where (digital) distribution partnerships come in.

Cutting Cost of Sales by Using Partnerships

I’ve worked with insurance distribution partners for more than a decade. The focus has, at all times, been on making a valuable outcome for all parties: The customer, the partner, and the insurer.

The distribution partner’s main focus is selling a product or service other than insurance. Insurance, for them, is a way to earn extra revenue and profit margins while strengthening customer loyalty.

Insurance is offered and sold to the customer either as part of the onboarding process or as an add-on to their natural transactions (marketers love to call this upselling).

For the insurer, the benefit is gaining access to the customer. The customer is more interested in the core product than the insurance. But by pairing the product with the insurance, the customers see the insurance product right at the moment when their desire or need peaks. In other words: Ka-ching!

Apart from the customer who’s in transactions (for instance, while buying a car or setting up an account), the partnership offers the insurer access to a kind of sleeping portfolio of the partner (as one of Penni.io’s clients once called it). It’s a large customer base that isn’t offered insurance products during a phase of the transaction.

This sleeping portfolio is more or less a large number of leads that have not actively asked for a quote. Typically, these customers are not offered coverage more than once a year. This is due to insurers' internal marketing rules limiting how often customers can be contacted.

To encourage them to buy the insurance, the insurer will usually offer a discount. And to encourage the partner to promote the insurance offer to this portfolio, the insurer will often pay a marketing fee. In the ideal partnership, that fee is lower than the insurer’s direct marketing costs.

Because of this marketing cost and the heavy discount offered to the customer, you, as an insurer, need a high conversion rate to make this profitable.

By using the partner’s existing digital touchpoints instead, customers get easy access to an insurance price calculator. This encourages them to start the quoting and buying process online.

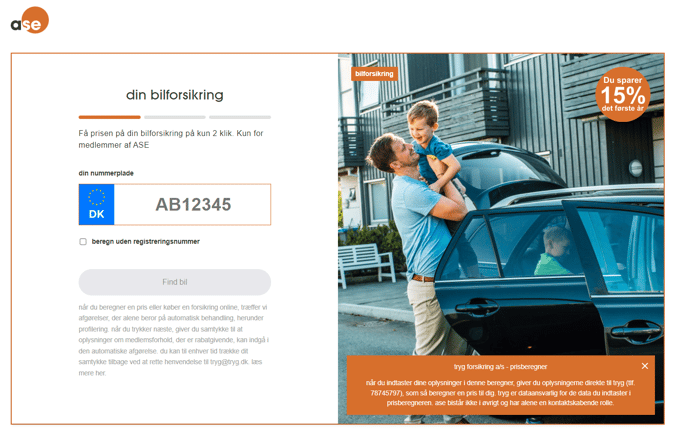

Here’s a Danish example of an embedded Penni.io widget. It’s on an insurance index page on the distribution partner’s website:

The customer has an easier onboarding process and a quicker purchase flow than with other insurance suppliers. The reason is that the customer can (with their consent) reuse/autofill information stored by the partner to calculate prices.

And that example, my friend, shows how you lower your cost of sales and upgrade customer convenience. The mix of the placing on the partner website and the ‘fast as a finger snap’ calculation given by the partner data means that:

- The insurer gets higher organic exposure, meaning unpaid traffic (customers land on the partner website instinctively because they’re interested in their product). It cuts the marketing cost for the insurer because the partner would run advertising on their website anyway. At the same time, the insurance offer can be exposed to more customers without further expenses for the insurer.

- The time-to-offer is greatly reduced. Time-to-offer means how many seconds pass from when the customer interacts with the insurance customer journey to when they see the price for the policy. And the shorter time, the higher conversion.

Digital distribution channels present the insurance offer to the customer precisely when the customer finds it most relevant. And it does so with no extra marketing cost than what’s invested in an existing partnership.

Thus, if you’d like to work with partners - and be happy when you look at your bottom line - you must be online like your partners.

Special thanks to our writer Esben Seyffart Sørensen (and king of data Francesco Cocozza)