Insurtech: A Sneak Peek at How Customers Decide to Buy - Volume 3

How to settle for a pricing strategy?

Today, we get nerdy! You might have heard about the psychology of price and how pricing should be contextual. This post is going to change your view of the factors that should be incorporated in the pricing model. When you distribute insurance digitally, your pricing strategy can change accordingly. Instead of setting a sellable price, you need to set a buyable one.

In this post, we’ll go over the difference between these types of pricing strategies and what you need to consider when setting a buyable price for digital insurance sales.

About the series

This is the third part in an ongoing series about insights into insurance customers — their behavior, their psychology, and why they buy. To learn more, see Part 1 (on behavioral economics) and Part 2 (on the paradox of choice).

This series is based on ongoing data insights gathered and analyzed at Penni.io. Our Penni Connect SaaS platform empowers companies all over Europe to partner up and distribute insurance products digitally. The widespread use of Penni Connect allows us to constantly develop and refine hypotheses about customer behavior (based on behavioural economics), test those hypotheses in real-time, and continually update the platform to ensure our partners have the most powerful and effective insurance sales solutions. That way, each Penni Connect partner benefits from our collective insights. And we’re committed to sharing some of those insights (the most peculiar, surprising, amusing, and useful ones) with you.

In this instalment, we will take a closer look at how digital partner distribution might affect the holy grail of insurance: risk calculation. Specifically the output of risk calculation: pricing.

Sellable prices vs. buyable prices

Most insurance companies spend a considerable amount of time getting their prices right. It’s a complex process that involves:

- The statistical likelihood of a customer filing a claim and getting a payout

- The company’s shared risk portfolio, capital management, cost of sales, operations, re-insurance pricing, and so forth

- Competitors and their pricing

All of these inputs, along with market trends and many others, come together to produce the perfect price for the product for a specific customer.

This pricing strategy, however, is based on calculating sellable prices — prices that make it possible for agents to sell more products. Indeed, if you raise prices, you can expect agents to complain about the “unsellable prices” every time they lose a customer or a lead goes cold. This is especially so when the agent’s fees are based on commission. That will be your loudest indicator that you’re dealing with a pricing strategy based around sellable prices.

But what happens when you take the agent out of the picture? How are things going to change when customers have to form their own opinions — by themselves — about the price of your product? In those cases, you’ll need to figure out the product’s buyable price. That doesn’t mean price dumping, unless you’re in a market that relies heavily on aggregators (which is not the case for many insures — customer seldom spent as much time on comparing prices as insurers think customers does). It means extending your pricing strategy with a few additional factors.

Going digital

Digitally distribution of insurance isn’t a process of taking an old product and putting it into a new distribution channel. Instead, it changes almost everything about the product itself. Selling digitally, then, means more than changing your strategy at the point of sale — it introduces possible changes from the ground up.

There are a lot of psychological factors that come into play when a customer is talking to an agent (in person or on the phone). When you move that process online, some of these psychological processes become more influential, some become less powerful, and brand new factors arise as well. We can see that just by looking at the data we’ve collected.

So, what have we learned from analyzing that data? Let’s have a look at some of the factors that will affect the buyability of the price and that could, therefore, be part of your digital pricing strategy. None of them is novel — they’re well-known concepts in the field of behavioral economics. What they all have in common, however, is that they have a much greater influence online than offline.

Each of these factors weighs differently on the customer’s decision-making process, but every single one of them has a significant effect. Be sure to include and test all of them when developing a pricing model for buyability.

5 additional factors for calculating a buyable price

Left digit effect

Ever notice that stores don’t often price their products with round numbers? You’re more likely to see something priced at €5.99 than €6.00, or €3.95 instead of €4.00. There’s a reason for that: the placement of a number in the price influences our overall evaluation of the price.

We read prices from left to right, and the further to the right a number is, the less strongly we register it. Because of that, we see €2.99 as being much cheaper than €3.00, even though the difference is negligible. Seeing that 2 on the left-hand side of the price primes us to see it as cheaper (and not just €0.01 cheaper).

If you’ve come up with a nice, round number for your product, shave a little bit of it off. Reduce the price by €0.01 to decrease the left-most digit and you’ll make your product look more affordable. You’ll lose €0.01 per sale, but you’ll more than makeup for that by increasing your sales volume.

Some numbers are easier to process

Insurance is an insanely complex product, and your customer’s brain will welcome anything that makes it easier to process.

In a previous post, we mentioned that the brain considers an easier decision to be a better decision. Think about it, why have we “picked” a Base-10 number system? It seems like an arbitrary choice, but it could also be based on the number of fingers we have. That’s a little bit speculative, but one thing we do know for sure is that the numbers 5 and 10 are easier to process than other numbers. Using this in your pricing strategy will make your product more buyable.

Note that this is in strong contrast to most pricing strategies for sellable prices, where the insurers want to show the exact price.

Number of digits

This is sort of a spin-off of the left digit effect. The number of digits has a high influence on price perception. Making the leftmost digit of the price smaller, even if you’re only reducing it by €0.01, makes it look much more affordable. That effect works even better if you can remove an entire digit.

For example, compare these prices: €100.05 and €100.00. There’s only a €0.05 difference between them, so they look like they cost almost the same. Now, compare another €0.05 price difference: €100.00 and €99.95. Doesn’t €99.95 just look and feel much more affordable? Your customer will think so, too.

Timescale

Quick: would you rather pay €12.95 monthly or €155.40 yearly?

The mathematician on your shoulder is probably screaming “they’re both the same!” But your gut probably made you gravitate to the monthly price. That’s because of the timescale. Intellectually, we can tell that the prices are identical in the end, but psychologically we compare a price to other money spent on the same timescale.

On a monthly timescale, we’re thinking about rent, cable bill, phone plan, and so on. In that context, €12.95 seems cheap. You can think of it as a little extra expense added on to your other monthly ones.

You probably don’t pay for a lot of things on an annual basis other than your taxes. That doesn’t give you a good sense of what €155.40 yearly means in terms of your other expenses, so it sounds rather pricey.

In most cases, presenting a customer with an annual price that is broken down into smaller monthly fees will make the product seem more affordable and will make them more likely to buy it.

The customer’s end goal

One of the most important things that make distributing insurance digitally a winning strategy is the concept of transactional proximity.

Briefly: no human has ever woken up in the morning and thought “Today, I want some insurance.” Insurance is always a means to an end, and the closer to that end you can get, the more likely the customer is to buy the insurance.

This also goes for the price. The perceived price of the insurance product is relative to the price of what the customer is buying and insuring. If a customer is buying a €25,000 car and is given an offer to simultaneously buy car insurance €50 (pr/mo), that will make the price of the insurance seem extremely small.

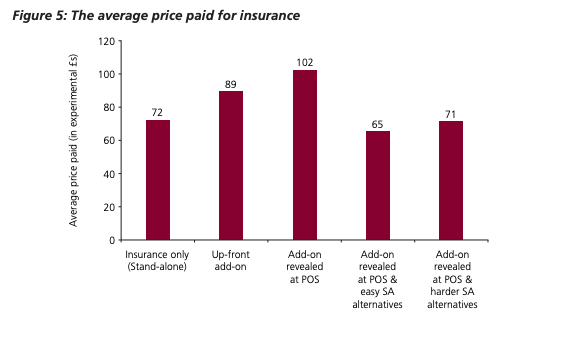

The British FCA also found this effect when testing how much customers were willing to pay for insurance presented to them at different parts of the sales flow.

In short, the closer the offer or insurance is to the point of purchase for the insured item, the more the customer is willing to pay.

Setting a buyable price

These factors, along with lots more data, show the importance of having a pricing strategy for calculating a buyable price for insurance products that are distributed online. Setting a buyable price will not only help you sell more policies but will also let you set higher premiums for them.

How do customers decide to buy insurance online?

Special thanks to our expert Simon Bentholm.